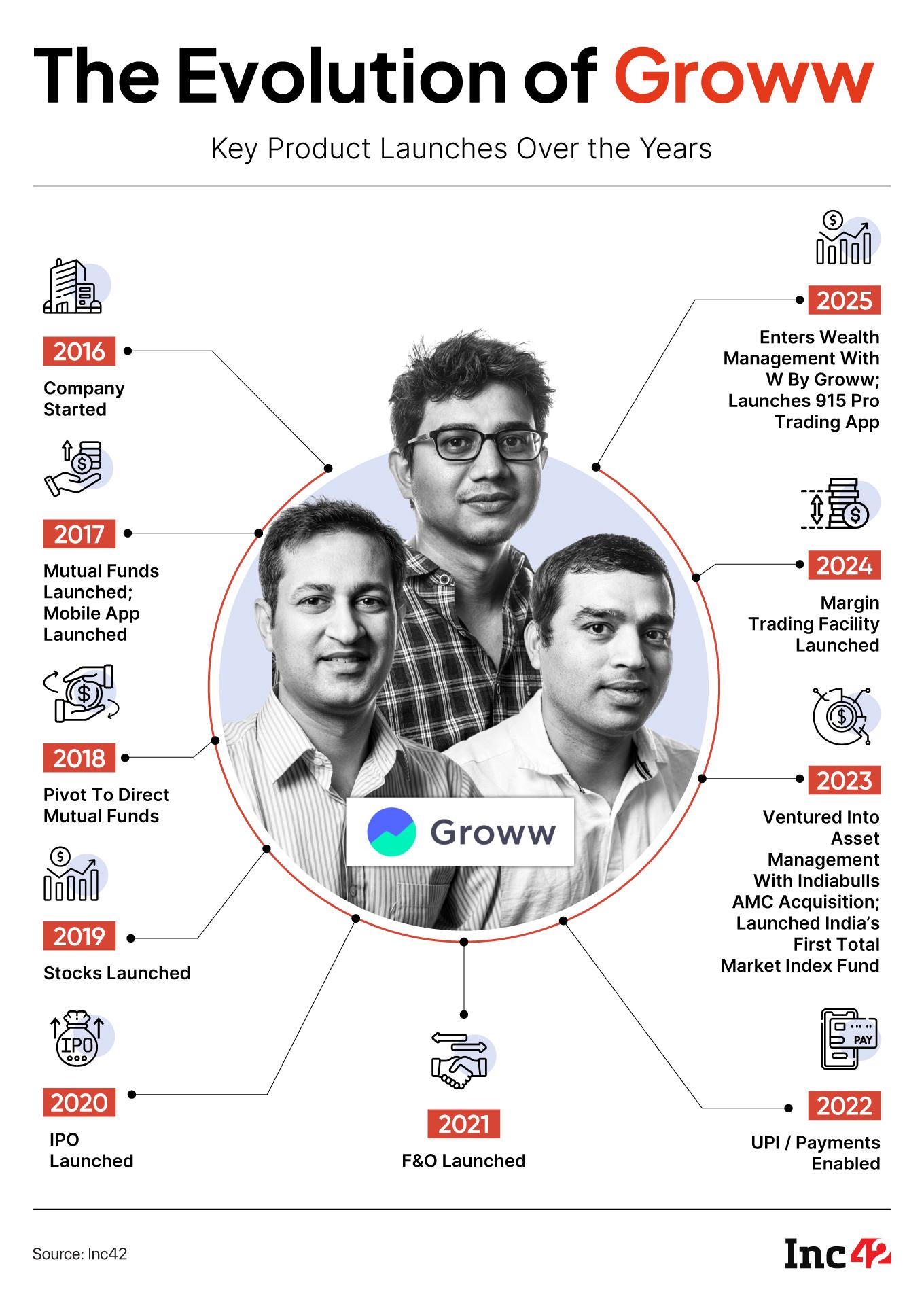

For years, the Groww narrative has been a deceptively simple one. Build a clean, intuitive platform, target the burgeoning mass of new-to-market retail investors, and ride the wave of India’s equity boom.

It was a strategy that paid off handsomely, catapulting the Bengaluru-based unicorn past its arch-rival Zerodha in active user numbers and setting it on a seemingly unstoppable march towards a blockbuster IPO. With over 1.5 Cr users, INR 1,819 Cr in profit for FY25 and a fresh $200 Mn in the war chest, Groww looks set for a bumper public listing.

But curiously, now there’s a change in Groww’s tune. It’s focussing on pro traders and HNIs with new products that are distinctly different from what made Groww such a big brand name in India. What does this mean for the investment tech giant?

Let’s try to answer this but first a look at the top stories from our newsroom this week:

- The Stock Broking Gold Rush: With revenue from digital lending under stress due to stringent norms, fintech startups are looking at stock broking to boost engagement and top line. From JFS to MobiKwik and CRED, competition is lining up to take on Zerodha and Groww

- India’s Deeptech Quandary: The Centre’s Research Development and Innovation (RDI) scheme earlier this month gave the deeptech ecosystem a sigh of relief, but behind closed doors, VCs and startups are famished for clarity

- Lenskart’s XR Vision: Lenskart is set to foray into the smart glasses and XR devices space and is changing its DNA for the next phase of its journey as it nears an IPO, but this is an altogether different ballgame than making spectacles and sunglasses. Will Lenskart be able to see this through?

Thus far, Groww’s story has been defined by profitability and rapid growth; the next chapter, particularly the diversification push through the wealth management and pro trading platforms, might throw up a challenge or two.

For Groww, the game is no longer just about democratising investing for the masses; it’s about chasing bigger fish in the investment pool.

The IPO-bound fintech giant is orchestrating a calculated move, designed to augment its revenue beyond the fiercely competitive, and often fickle, retail segment.

This isn’t just about adding a few new features. In many ways, it’s a fundamental shift towards courting niche, high-value customers: the professional, high-volume traders and the ultra-rich high-net-worth individuals (HNIs).

This diversification is the name of the game, a direct response to the pressures of a maturing, highly-competitive market and the ever-present need to show growth.

The bloodbath on the stock exchanges in early 2025, which saw both Groww and Zerodha witness a significant erosion in their active user base, served as a stark reminder of the vulnerabilities of relying too heavily on fair-weather retail investors.

When the market corrects, the activity from this segment drops. This phenomenon, as Zerodha’s Nithin Kamath admitted, led to a 30% decrease in activity across brokers and caused the first business degrowth for his company in 15 years. For an IPO-bound company like Groww, such volatility is a liability.

Groww’s Need For DiversificationThe answer, it seems, is to build new verticals. First, there’s the launch of ‘915’, a standalone, web-based platform built in-house specifically for professional and high-volume traders.

Offering advanced tools like historical straddle charts and customisable dashboards, ‘915’ is a clear signal that Groww is moving beyond its simple, user-friendly mantra to cater to a more sophisticated, demanding clientele. This is a move to shore up revenues, especially as SEBI tightens the screws on F&O trading for retail investors, a key revenue source for many brokerages.

The second, and perhaps more significant, prong of this strategy is a full-fledged leap into wealth management. Groww has also launched ‘W’ to provide Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) to its affluent users. This isn’t a tentative step; it’s a strategic invasion of a territory traditionally dominated by banks and specialised firms.

To bolster this ambition, Groww has made a significant move by acquiring wealthtech startup Fisdom in an all-cash deal valued at around $150 Mn. Fisdom brings not only its expertise but also established partnerships with 15 national and regional banks, providing a ready-made launchpad for Groww’s HNI ambitions.

The company plans to build an omnichannel, physical presence, recognising that high-value transactions require a human touch—a level of trust that a purely digital interface might not command.

How will Groww’s direction be shaped by this omnichannel strategy?

Competition Bearing DownGroww’s core identity may not be at risk, but these new verticals do push Groww into a dichotomy. For years, Groww has been known as the friendly investment app, simplifying the jargon-filled world of investing, educating investors on making the right decisions.

Now, it’s also building exclusive, high-end suites for the financial elite or wealthy individuals. The challenge is immense: how do you create a bridge for your customers to move from a simple SIP to a complex AIF, or from a casual stock purchase to a high-frequency trading setup, without being seen as pushing them?

This is where the shadow of Zerodha looms large. Zerodha has built its brand on a very public philosophy of not nudging users to trade more.

For new-age fintech startups, the real risk to bigger digital players like Zerodha and Groww isn’t just a massive user decline, but shrinking engagement as new players fragment user attention. The challenge is to adapt to a post-derivatives world—where long-term investing, advisory services, and experience-led loyalty will matter more than raw trading volume.

Groww’s new strategy puts it on a direct collision course with this ethos. By building these sophisticated new verticals, Groww is creating powerful internal pathways to upsell and cross-sell. There is immense pressure to guide its 1.5 Cr-strong user base towards these new, more lucrative offerings.

How does a company that educated the masses about the risks of the market now entice them into the higher-stakes game of professional trading and wealth management without overexposing them to risk? This tightrope walk will test the company’s ethical compass and its product design philosophy.

There’s also the matter of the public listing. The confidential route for IPO filing has created some intrigue. It allows Groww to control the narrative, to present its financials at a preferred time, and to shield its strategic shifts from the prying eyes of competitors who are also gunning for a piece of the wealthtech pie. But this secrecy only delays the inevitable public scrutiny.

Eventually, the market will demand answers. Like whether Groww can seamlessly integrate its past — targeting Indians in cities and hinterlands — with its new wealth management and professional trading ambitions and monetising the user base.

There’s no reason to panic, of course. Companies go through this trajectory all the time and sometimes, it’s a necessary evolution. Groww has not shown any signs of handling such changes badly in the past.

It’s definitely an interesting challenge to solve and a critical time from a competition point of view in the investment tech ecosystem.

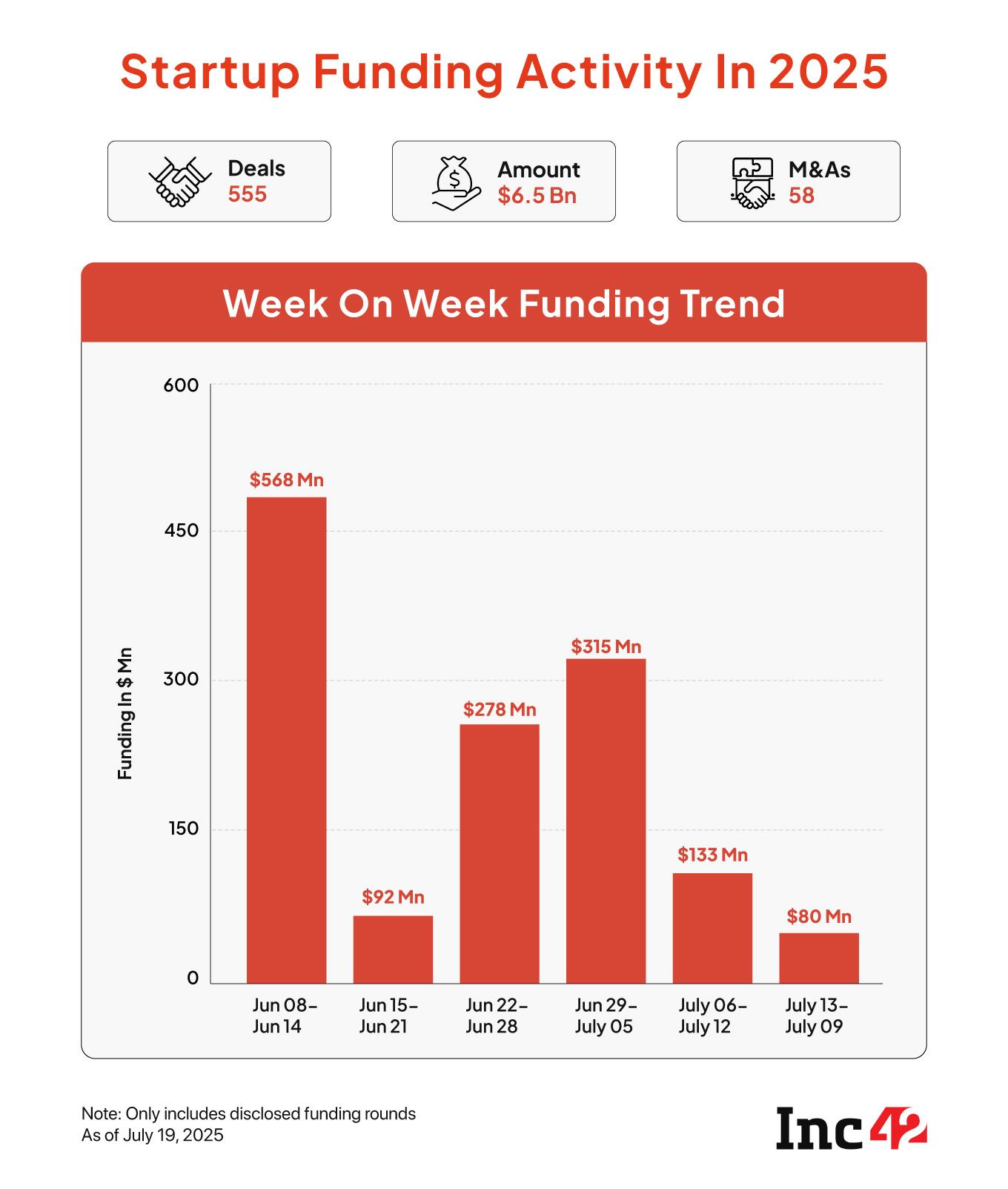

Sunday Roundup: Startup Funding, Pivots And More- Weekly Funding Down: Between July 14 and 19, startups raised $79.7 Mn across 21 deals, down 40% from the $132.9 Mn secured by 17 startups in the preceding week

- Rebel Shake-Up: In a major top-level reshuffle, IPO-bound cloud kitchen unicorn Rebel Foods has elevated cofounder and India CEO Ankush Grover to the post of global CEO

- Zepto Cafe Takes A Backseat: The quick commerce major is scaling down its 10-minute food delivery service due to supply chain issues and staff shortage, after already shutting down 44 cafes last month

- Will MDR Tide Lift All UPI Apps? Fintech stakeholders have been lobbying the Centre to charge MDR on large merchants for transactions above INR 2,000. But, who among top fintech players will benefit the most from the potential regime?

- Blinkit’s Inventory-Led Pivot: The Eternal-owned quick commerce major will switch to the new model, but what does this mean for Blinkit and the thousands of sellers on its platform?

The post Groww’s New Formula: Be Everything To Everyone appeared first on Inc42 Media.

You may also like

Kolkata hosts nationwide quiz contest 'Anvesha 2.0' to celebrate 75 years of National Sample Survey

Solitaire players are just realising Microsoft 'totally changed' card game's name

Bihar Police arrests prime accused, 3 associates in Patna hospital murder case

'Ridiculous!' GB News guest rages in furious rant over migrant hotels

TMC's Mamata Banerjee to sharpen Bengali pride pitch at Martyrs Day rally amid migrant row