India is decidedly a two-wheeler market when it comes to electric vehicles. A projects that electric two-wheelers will make up 60-70% of new vehicle sales by 2030, but global EV brands remain out of reach for most consumers due to astronomical prices. The shift to green mobility is taking place, nonetheless, driven by homegrown startups, electric 2Ws that combine affordability with reliable technology.

The journey could have been smoother, but for technological setbacks and compliance conflicts amid a regulatory landscape shaped by FAME India and its incentive schemes. Besides early movers like Ather Energy and Ola Electric, the likes of Ultraviolette, Oben Electric and River Mobility are redefining EV consumer segments and niche markets.

While Ola Electric, Ather Energy and legacy giants such as Hero MotoCorp, TVS and Bajaj Auto continue to rule in terms of market share, the new breed of EV makers is rapidly gaining traction through focussed positioning and strong brand narrative, primarily targeting urban millennials, performance enthusiasts and design-first buyers.

Among these, Bengaluru-based River has emerged as a notable outlier, posting solid numbers in the past few months, and outpacing many older peers.

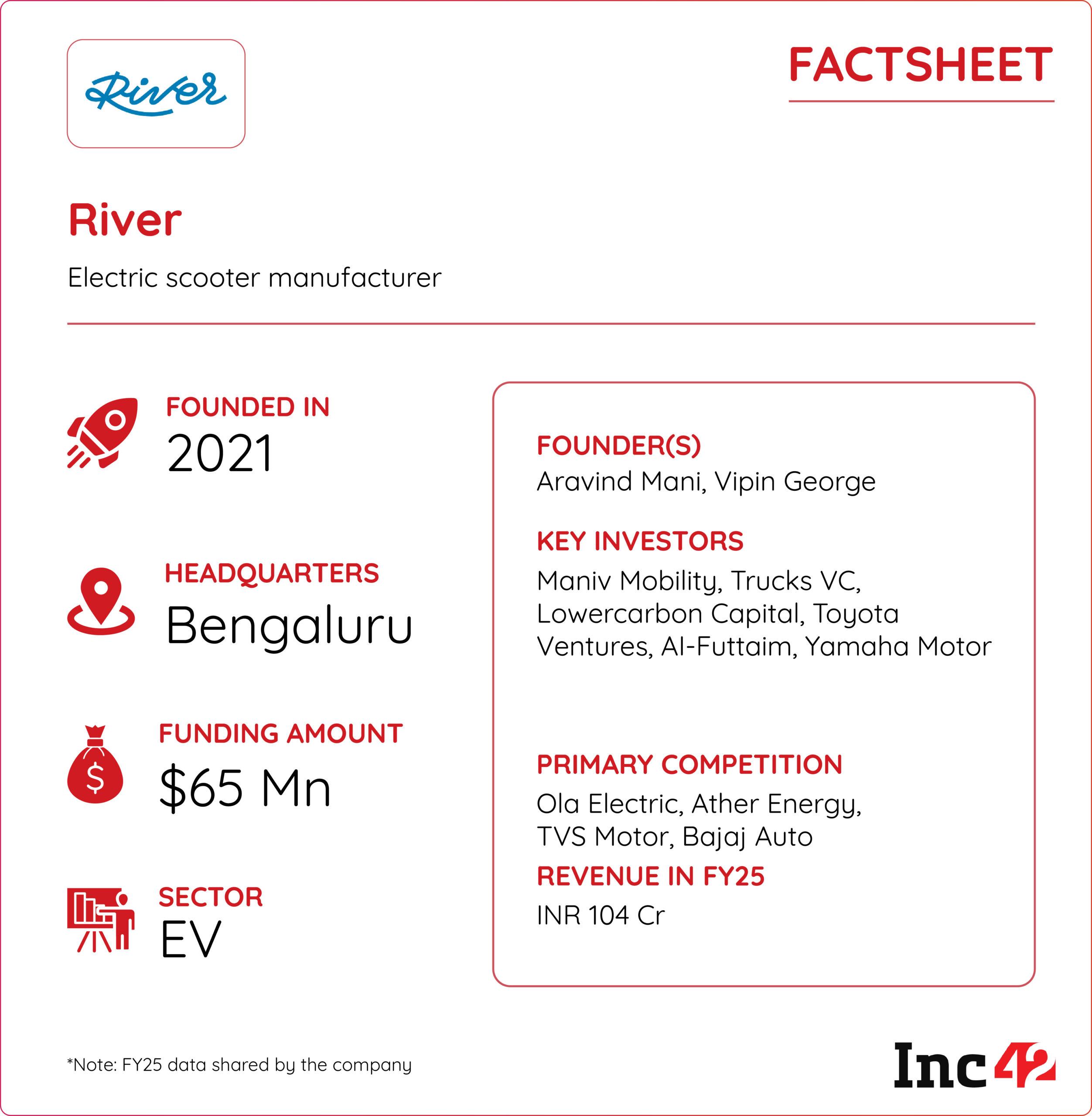

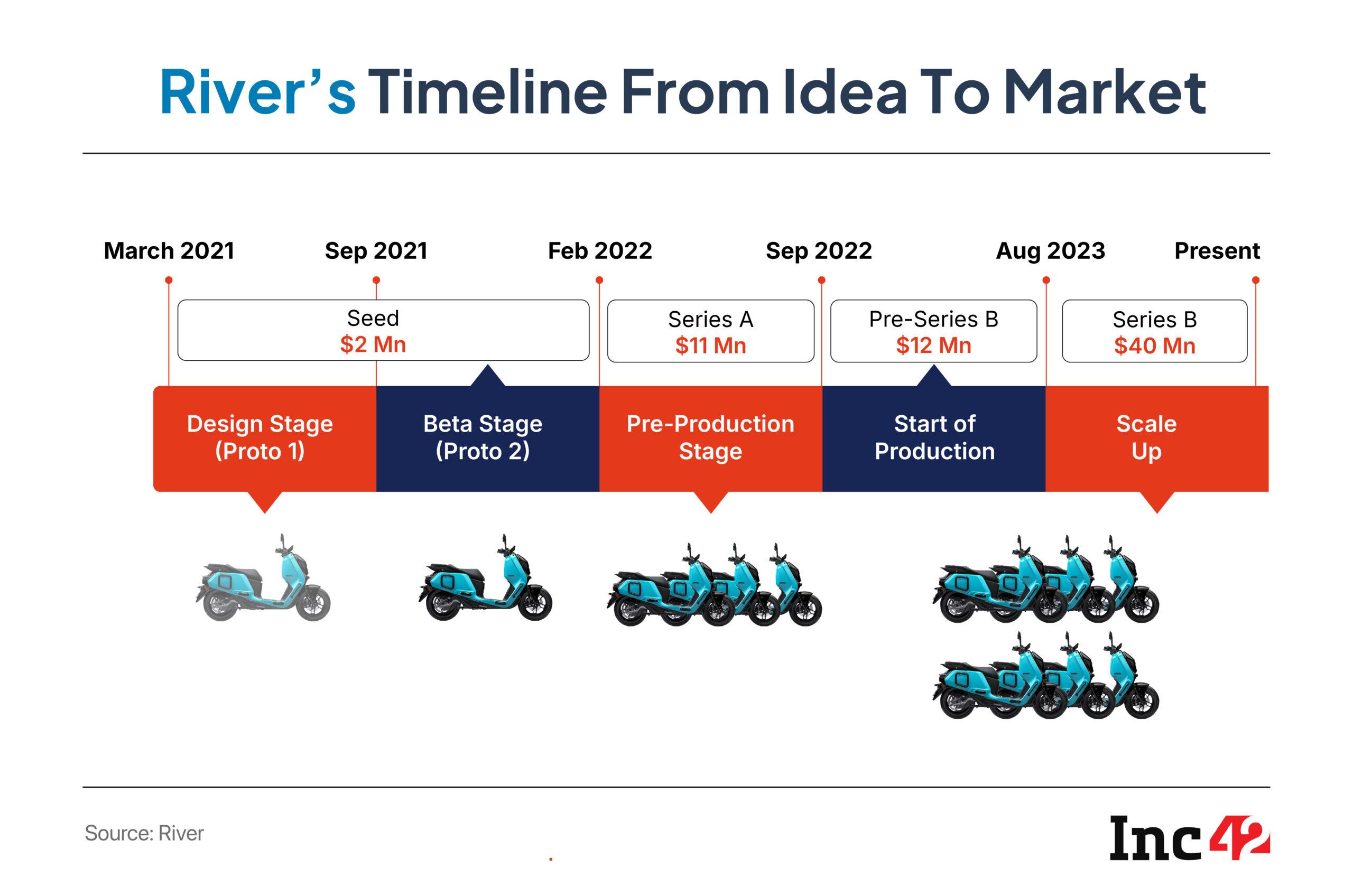

Set up in 2021 by former Ultraviolette executives Aravind Mani and Vipin George, River claims that it took just 27 months to bring its flagship model Indie from the drawing board to the market, with just $25 Mn invested in its development.

As per Vahan data, the startup sold 4,246 EVs in FY25, which jumped 11X from 386 units of EVs sold the previous fiscal. However, the company said that its escooters sales crossed 6,100 in FY25, and this difference is due to the accounting of Telangana sales numbers.

River’s EV OriginWhen most hardware startups in India struggled to raise funding, River bucked the trend, utilised minimum capital and built a brand that stands out in the not-so-glamorous escooter market. Till date, the company has raised $65 Mn (around INR 555 Cr) across four funding rounds.

So, what exactly did River do differently? According to founder and CEO Mani, the answer is: people, process and culture.

For cofounder George, starting an automobile company had long been a personal ambition. This is what took him to Ultraviolette where he was the design lead till 2020. At the same time, Mani was the VP of business operations and strategy at the company.

The idea of River took shape during the Covid-19 pandemic. Amid the nationwide lockdowns, both founders left their jobs at EV maker Ultraviolette, and began exploring opportunities to start up. But investor sentiment was anything but favourable at the time.

“We got very negative responses from all over India. No one was prepared to fund a hardware startup,” recalled Mani.

The duo gave themselves a deadline. They would go ahead with the startup if they could raise $2 Mn within a year. If not, they would return to a job.

Their patience paid off. In 2021, River secured its first $2 Mn in seed funding from Israel’s Maniv Mobility and US-based Trucks VC, both making their maiden investments in India. And by the time River closed its , led by the US-based Lowercarbon Capital and Toyota Ventures, it had already built 15 prototypes.

Funds from the Series A went towards setting up a manufacturing unit in Hoskote on the outskirts of Bengaluru. By the time River was preparing to raise , this factory was nearing completion. This round brought another marquee investor to its cap table: Japan’s automotive Yamaha Motors.

By early 2024, with its manufacturing plant readying full capacity, River had already sold 100+ vehicles.

Today, it boasts a 70K sq ft R&D facility and a vehicle assembly plant capable of producing 8K escooters every month. However, River currently operates at 25% manufacturing capacity.

“One of the most important aspects of building an automotive company is understanding how to raise capital. Many investors are not familiar with the space. So, you need to translate your progress into clear, tangible milestones. Although we adopted industry best practices, the biggest challenge was proving progress in a way investors could grasp. That’s where many startups falter,” said Mani.

According to Mani, River sold its first escooter 27 months after the venture was set up and opened its first retail store three months later. Since then, it has scaled rapidly, but the growth is not random.

Recognising the challenges of introducing a new product, River ensured that it launched a dedicated service centre in each city before starting sales. Consequently, in its inaugural year, EVs were sold in three southern Indian cities — Bengaluru, Chennai and Hyderabad.

Building The ‘SUV Of Electric Scooters’Getting an electric scooter out of the factory is no easy task, especially one that is being made from scratch and not just being put together in India.

For River, which has invested heavily in R&D and proprietary technology, product differentiation was essential. The startup’s edge lay in George’s extensive experience at Honda and his background as an EV designer. The startup also had a team of seasoned automotive engineers whose industry expertise would help define the value proposition. River also claims it has 16 approved patents in its kitty.

It also helped that River focussed on a largely overlooked segment — utility-focussed electric scooters.

“When we began ideating, no one was building EV two-wheelers for the utility market,” said the CEO. “Hero catered to rural commuters, Honda to urban ones, and TVS was a family scooter brand — all of them rooted in their ICE lineages. But no one had dared to build a stylish, utility-first escooter in India. People were repurposing standard models for utility needs. So, we decided to make utility our core value proposition and built Indie.”

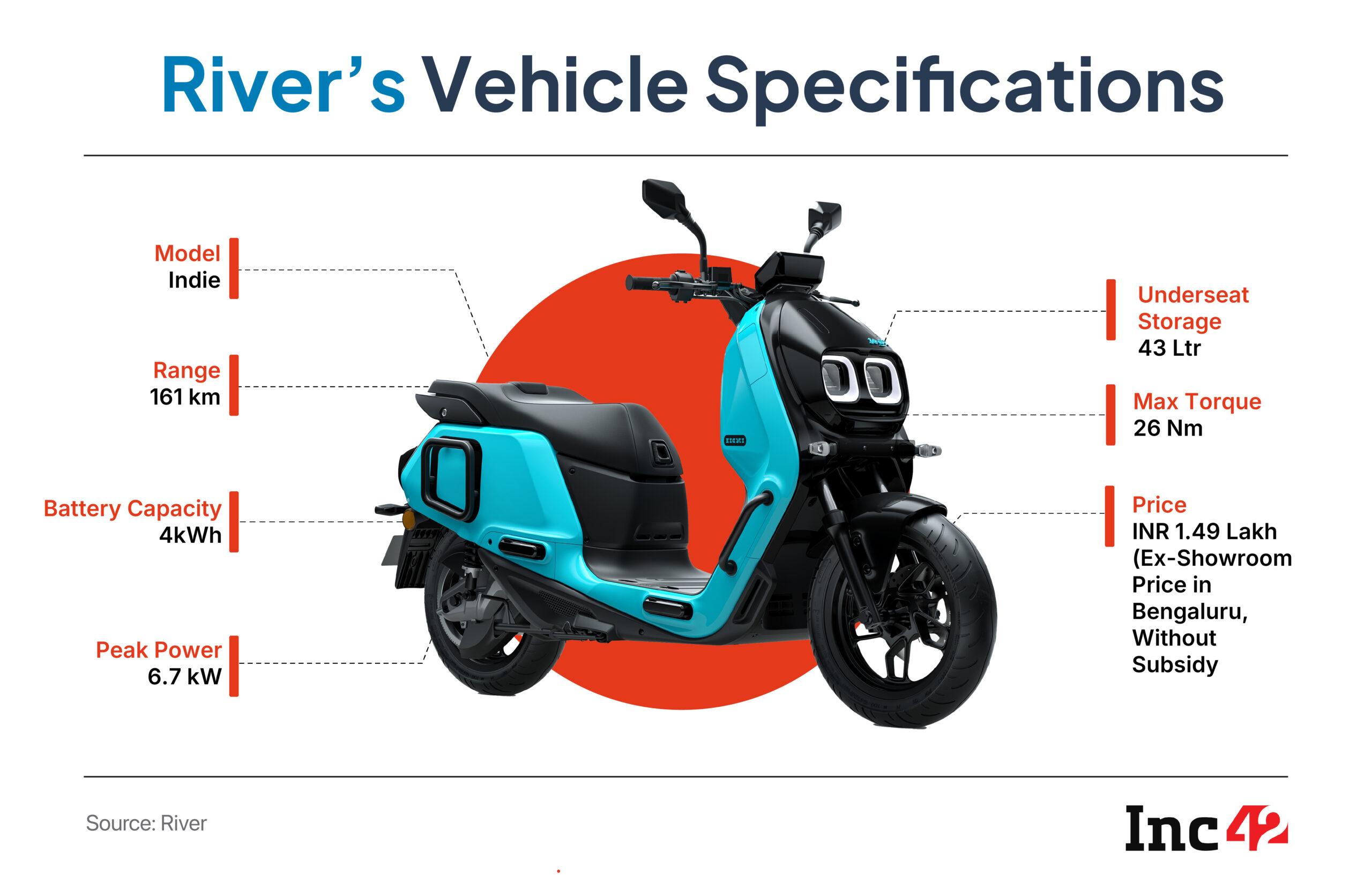

It is no surprise that River brands its flagship as the ‘SUV of scooters’, a nod to both style and convenience.

The idea was to build a two-wheeler equivalent of the pickup trucks in the US so that India’s growing cohort of solo entrepreneurs, from carpenters and builders to small business owners, can carry their tools of trade in a single vehicle. Indie has an underseat storage of 43 litres, more than most rivals in the market. By comparison, Ola Electric offers up to 32 litres, Ather 22 litres and TVS 34 litres.

River claims to have designed all key components in-house, including the battery pack and the battery management system (BMS), vehicle control unit, connectivity module, electrical architecture and drivetrain. It also holds intellectual property rights for its mechanical and electrical architecture. Although the startup sources NMC cells from China and procures its motor and controller from the German manufacturer MAHLE, all other major components are developed internally.

River Joins India’s EV OceanThe EV sector in India experienced turbulence in recent years. After investigations revealed that many companies had violated domestic sourcing norms, the government slashed subsidies under the FAME-II scheme. The crackdown and subsequent subsidy cuts wreaked havoc as EV prices soared, sales slumped, and several startups failed to scale or shut shop entirely.

River managed to escape much of this turmoil. It began commercial operations when the subsidy shake-up had already taken its toll, leaving little scope for new players to lean on government incentives.

Moreover, it did not qualify for the government’s production-linked incentive (PLI) scheme, which mandates a minimum investment threshold of INR 2K Cr, well above the startup’s capital expenditure.

Mani considers this a blessing in disguise. “We have been able to scale our business with far less, which has made us more disciplined and efficient,” he said.

But the road ahead is far from smooth. One of the biggest hurdles, for example, to widespread EV adoption is inadequate charging infrastructure in India.

This particularly impacts electric two-wheelers without standardised charging systems. For now, most users rely on home charging, but broader uptake will hinge on the availability of public infrastructure.

Ola Electric and Ather Energy have invested in their proprietary charging networks. River, by contrast, is taking a more frugal route. Rather than building the infrastructure from scratch, it is developing universal adapters to enable plug-and-charge at any public charging point.

More importantly, product improvement remains a work in progress. Although Indie, now in its second iteration, has gained traction as evidenced by the numbers, customers have voiced concerns about the quality of headlights, switches, and the overall charging experience.

Mani acknowledges these gaps but believes the startup’s sole focus on its flagship will help it fix these issues without delay. “Currently, we are concentrating on just one vehicle. So, we can channel all our resources into getting it right,” he said.

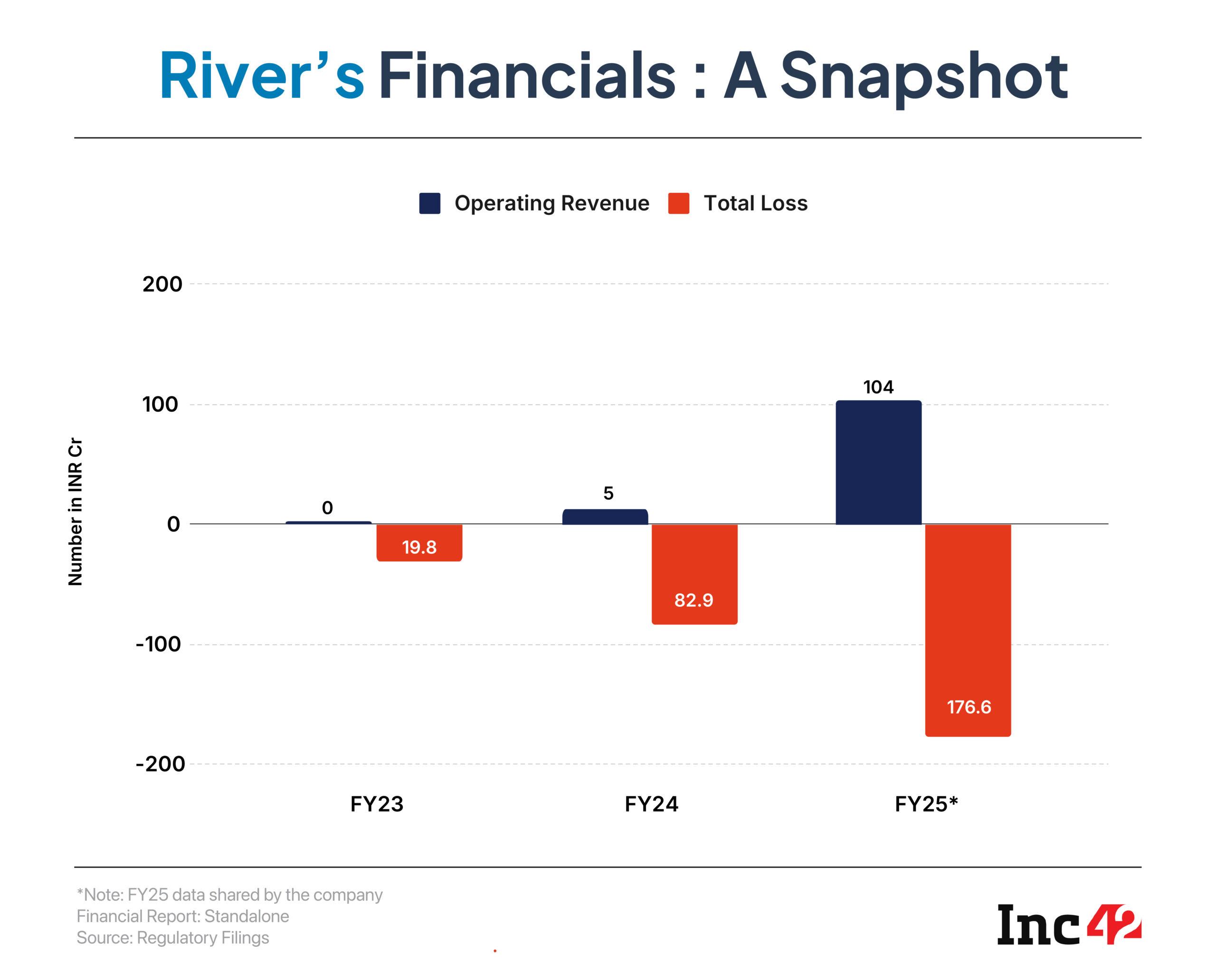

The company kicked off sales in October 2023 and closed its first full financial year (FY25) with INR 104 Cr in revenue. This marked a nearly 21X jump from INR 5 Cr recorded in FY24 when it had just six months of sales. The Indie remains the sole product from River’s stables, but a new model is likely to hit the market by 2026.

The startup is still in the red, and losses are mounting due to retail expansion. River’s losses more than doubled in FY25 to INR 176.6 Cr from INR 82.9 Cr in the previous fiscal year. However, the founders strongly believe in its growth prospects, emphasising that a rise in production and aggressive sales and marketing will help it hit the profitability button.

River is targeting 30K escooter sales in the current financial year (FY26), a nearly fivefold increase from FY25.

At peak production capacity, it expects to manufacture 100K escooters annually and projects INR 1,400 Cr in revenue. It is planning to expand its retail network to 120 stores across all the major Indian cities by March 2026 to support this scale, with more than half (64) concentrated in South India.

“We are quite bullish on breaking into the sixth or seventh spot nationally. Going further will take time as the top EV players today have at least 200 stores. Then again, we sold 1K units with only 16 stores. Plus, we are priced higher. Indie costs around INR 1.5 Lakh, but many players in the sixth to ninth spots sell products below INR 1 Lakh. So, our achievement in that market has been phenomenal,” Mani added.

River is already among the top 10 EV two-wheeler brands in Karnataka and Kerala. But staying competitive will be increasingly challenging as more players crowd the segment.

Will its retail expansion and production ramp-up reverse the current losses?

“Human resources are our single biggest expense today,” said Mani. “It is because when selling 1,000 EVs, we are staffing up for 3,000. It is about building the pipeline and investing in workforce and infrastructure.”

In fact, the headcount at River doubled YoY, reaching 839 in FY25, with costs ballooning to INR 90 Cr from INR 26 Cr a year ago.

In a sector hit by regulatory volatility and adoption challenges, River is steering towards greater self-reliance. “We have not burnt much cash to get here. There’s a lot of headroom, and we can become one of the top 10 players, if not the top five, and achieve profitability, even if we are not gunning for an IPO right now,” he said.

The company has no immediate plans for fundraising but wants to delve deeper into the utility-lifestyle spectrum while rolling out its second escooter model.

Having come this far through careful execution and capital discipline, River now faces a tougher challenge: scaling without excessive dilution or a forced acquisition while claiming a distinct space in India’s crowded EV landscape. It is still uncertain whether its leaner model and measured bets can yield long-term sustainability. For now, though, the current appears to be running in its favour.

[Edited By Sanghamitra Mandal]

The post appeared first on .

You may also like

Morning news wrap: Muslim side urges SC to stay Waqf Amendment Act, MS Dhoni brutally roasted as netizens ask for IPL retirement & more

Gemini AI app crosses 400 million monthly active users: Sundar Pichai

BJP-Shiv Sena will have to swallow criticism, sit with Bhujbal: Shiv Sena(UBT) in Saamana

'Journey full of love': What 'spy' Jyoti Malhotra wrote in her personal diary about 10-day Pakistan trip

PM Modi pays tributes to Rajiv Gandhi on 34th death anniversary