MUMBAI: Low inflation has stepped up expectations of rate cuts, but their size and timing hinge on growth trends, with the impending trade deal between India and the US and the likely demand boost from GST cuts being key monitorables.

The central bank's commentary at Wednesday's monetary policy meeting, economists said, suggest the repo rate drifting lower toward 5% by February if the tariff rate stays at 50%. Conversely, the easing cycle may bottom out if tariffs ease and domestic consumption improves.

"A December cut is going to be very conditional," Gaura Sen Gupta, chief economist, IDFC First Bank, told ET. "A 50% tariff definitely drags growth. There would be a repo rate cut if tariffs remain high and there isn't any trade deal or if they actually see that consumption on the ground is not responding to the GST cuts."

US President Donald Trump will visit Kuala Lumpur for the summits of ASEAN and East Asia leaders from October 26 to 28. New Delhi would likely look at a possible bilateral meeting between Prime Minister Narendra Modi and President Trump and work out a trade deal on the sidelines of the East Asia summit.

Soumya Kanti Ghosh, group chief economic adviser, State Bank of India, said the Reserve Bank of India ( RBI) has kept the door ajar for future rate cuts with seemingly low inflation forecasts and downward adjustments to growth. But the timing of such cuts would keep everyone guessing.

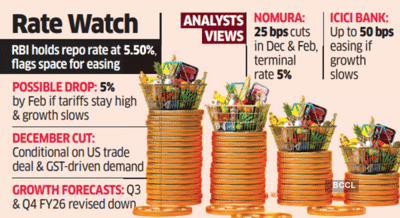

On Wednesday, the RBI's Monetary Policy Committee (MPC) kept the policy repo rate unchanged at 5.50%, with governor Sanjay Malhotra acknowledging space for easing to further support growth.

There has also been a notable change in the language with the MPC saying that "sobering of inflation has given greater leeway for monetary policy to support growth." In August, the MPC had said that "monetary policy has used the policy space created by a benign inflation outlook."

Space for Two?

Sameer Narang, head - economic research group, ICICI Bank, said while the space seems currently adequate for a 25-basis point cut, another 25 bps of reduction is possible if growth slows further from the current trajectory.

Nomura has retained its terminal repo rate forecast of 5%, with 25 bps cuts each in December and February policy meetings. The central bank also highlighted that there remains risk to H2 FY26 growth momentum and consequently revised down its Q3 and Q4 FY26 growth projections.

"If tariff risks subside over the coming quarter and global growth in major trading partners holds up better than expected, we see an upside bias to our FY26 GDP forecast, which is at 6.6%," Sakshi Gupta, principal economist, HDFC Bank, said in a report Wednesday.

The central bank's commentary at Wednesday's monetary policy meeting, economists said, suggest the repo rate drifting lower toward 5% by February if the tariff rate stays at 50%. Conversely, the easing cycle may bottom out if tariffs ease and domestic consumption improves.

"A December cut is going to be very conditional," Gaura Sen Gupta, chief economist, IDFC First Bank, told ET. "A 50% tariff definitely drags growth. There would be a repo rate cut if tariffs remain high and there isn't any trade deal or if they actually see that consumption on the ground is not responding to the GST cuts."

US President Donald Trump will visit Kuala Lumpur for the summits of ASEAN and East Asia leaders from October 26 to 28. New Delhi would likely look at a possible bilateral meeting between Prime Minister Narendra Modi and President Trump and work out a trade deal on the sidelines of the East Asia summit.

Soumya Kanti Ghosh, group chief economic adviser, State Bank of India, said the Reserve Bank of India ( RBI) has kept the door ajar for future rate cuts with seemingly low inflation forecasts and downward adjustments to growth. But the timing of such cuts would keep everyone guessing.

On Wednesday, the RBI's Monetary Policy Committee (MPC) kept the policy repo rate unchanged at 5.50%, with governor Sanjay Malhotra acknowledging space for easing to further support growth.

There has also been a notable change in the language with the MPC saying that "sobering of inflation has given greater leeway for monetary policy to support growth." In August, the MPC had said that "monetary policy has used the policy space created by a benign inflation outlook."

Space for Two?

Sameer Narang, head - economic research group, ICICI Bank, said while the space seems currently adequate for a 25-basis point cut, another 25 bps of reduction is possible if growth slows further from the current trajectory.

Nomura has retained its terminal repo rate forecast of 5%, with 25 bps cuts each in December and February policy meetings. The central bank also highlighted that there remains risk to H2 FY26 growth momentum and consequently revised down its Q3 and Q4 FY26 growth projections.

"If tariff risks subside over the coming quarter and global growth in major trading partners holds up better than expected, we see an upside bias to our FY26 GDP forecast, which is at 6.6%," Sakshi Gupta, principal economist, HDFC Bank, said in a report Wednesday.

You may also like

NIRF to begin negative marking for dishonesty

Tottenham takeover latest as £21bn businessman issues update

Jihad Al-Shamie named as Manchester synagogue attacker by police

Festive spirit soars during Dussehra with iconic Ravan dahan in major cities

Conspiracy theorist mum's anti-chemo views influenced daughter's death